Should You Convert to a Roth IRA?

"Whether an investor benefits from converting assets within a traditional IRA to a Roth account may depend on the amount of time he or she plans to leave the assets invested, estate planning strategies, and his or her willingness to pay the federal income tax bill that a conversion is likely to trigger."

Should you convert all or a portion of your traditional IRA assets to a Roth account? The answer may depend on the amount of time you plan to leave the assets invested, your estate planning strategies, and your willingness to pay the federal income tax bill that a conversion is likely to trigger.

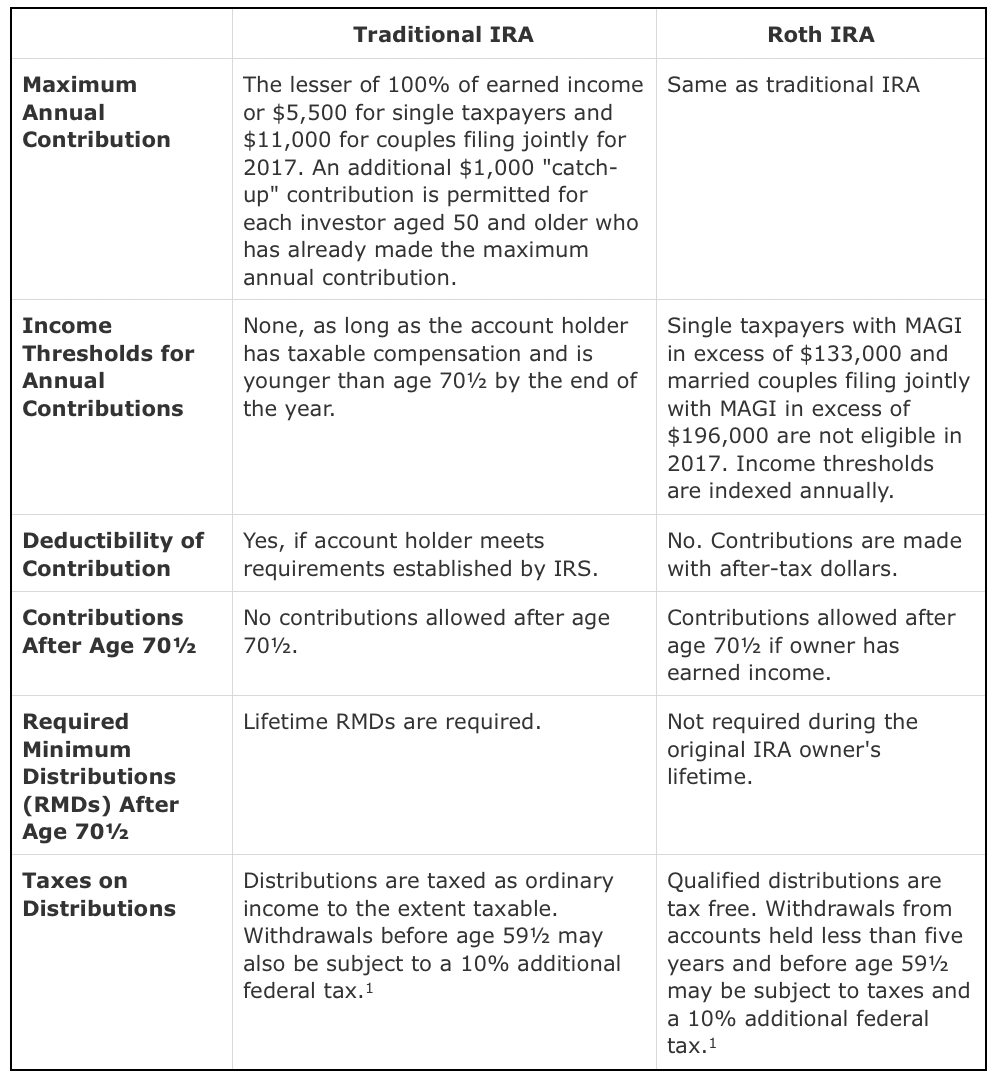

Two Types of IRAs

Each type of IRA has its own specific rules and potential benefits. These differences are summarized in the table below.

Conversion: Potential Benefits . . .

Potential benefits of converting from a traditional IRA to a Roth IRA include:

- A larger sum to bequeath to heirs. Since lifetime RMDs are not required for Roth IRAs, investors who do not need to take withdrawals may leave the money invested as long as they choose which may result in a larger balance for heirs. After an account owner's death, beneficiaries must take required minimum distributions, although different rules apply to spouses and nonspouses.

- Tax-free withdrawals. Even if retirees need withdrawals for living expenses, withdrawals are tax free for those who are age 59½ or older and who have had the money invested for five years or more.

. . . As Well as a Potential Drawback

- Taxes upon conversion. Investors who convert proceeds from a traditional IRA to a Roth IRA are required to pay income taxes at the time of conversion on investment earnings and any contributions that qualified for a tax deduction. If you have a nondeductible traditional IRA (i.e., your contributions did not qualify for a tax deduction because your income was not within the parameters established by the IRS), investment earnings will be taxed, but the amount of your contributions will not. The conversion will not trigger the 10% additional tax for early withdrawals.

Which Is Right for You?

If you have a traditional IRA and are considering converting to a Roth IRA, here are a few factors to consider:

- A conversion may be more attractive the further you are from retirement. The longer your earnings can remain invested, the more time you have to help compensate for the associated tax bill.

- Your current and future tax brackets will affect which IRA is best for you. If you expect to be in a lower tax bracket during retirement, sticking with a traditional IRA could be the best option because your RMDs during retirement will be taxed at a correspondingly lower rate than amounts converted today. On the other hand, if you anticipate being in a higher tax bracket, the ability to take tax-free distributions from a Roth IRA could be an attractive benefit.

There is no easy answer to the question "Should I convert my traditional IRA assets to a Roth IRA?" As with any major financial consideration, careful consultation with a financial professional is a good idea before you make your choice.

Source/Disclaimer:

1 IRA account holders (both traditional and Roth) may avoid the 10% additional federal tax on withdrawals before age 59½ only if they meet specific criteria established by the IRS. See Publication 590-A for more information.

Required Attribution

Because of the possibility of human or mechanical error by DST Systems, Inc. or its sources, neither DST Systems, Inc. nor its sources guarantees the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. In no event shall DST Systems, Inc. be liable for any indirect, special or consequential damages in connection with subscriber's or others' use of the content.

© 2017 DST Systems, Inc. Reproduction in whole or in part prohibited, except by permission. All rights reserved. Not responsible for any errors or omissions.

The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own (or paste your own from a different source).

To control the color or size of this text, please change the global colors or text size under the Design section from the left menu of the editor.

- Mullin's take on the "4% Retirement Rule"

- Navigate "Bad Portfolio Weather"

- Tips to Optimize Social Security

Articles and Assets

What are your Priorities?

Well it’s the end of the year. I just searched on Google for “market outlook 2018.” I came up with a little over 58-million “results.”

So should you be investing in stocks in 2018? The quick answer: It’s likely a prudent part of your portfolio. But it depends on your circumstances, right?

It’s apparently popular to throw your hat in the ring.

A mantra that you hear among disciplined professionals is to “stay the course.”

Then you hear “sell high, buy low.”

Who’s right?

The relief of a disciplined strategy is that it can be tailored to you. And tailor we think you should.

Yes, it’s possible that an investor may not utilize stocks in their portfolio at all. Or you may decide to go “all in” with a diversified stock portfolio.

(Side effects from tailoring a strategy may include increased confidence & persistence, apathy toward daily market reports, and increased focus on what really matters.)

Let’s begin with the “Why” of investing for you. Then you can request 15-minutes on the phone discuss your “how.”

So “Why Should You Invest”

Life changes and our “why” of investing ought to transform with life. Some invest for sport – they like the risk/reward of investing – they’re in it for the thrill. I don’t hang with this crowd.

Most of us ought to invest for things we want. Our money & our goals are serious. By investing in a diversified portfolio we can pursue things we want.

1. Living A Comfortable Retirement: Retirement is a noun. It’s up to you to really design and live a retirement that reflects you.

2. Purchasing a Home: Home is a place to live. It can take a down payment.

3. Passing an Inheritance on to Family:

4. Student Loan Shield: This idea is important for many Millennial graduates. Student loans can dominate your budget. But instead of accelerating those payments, what if you paid your required payments, and then invested the additional money that you were going to pay against your loan balance?

5. Emergency Reserves: You probably have read that it’s prudent to keep a relative healthy amount of cash in your checking/savings. Once you’ve achieved that, then you can consider investing additional funds. Go a step further and consider a non-retirement account for you and your house. You can spend this on cars, vacations or use it just as described in #4.

The Dow Jones has seen positive results, so far, in 2017. It’s unusual and sort of uncomfortable as the independent financial advisor. Why is it uncomfortable?

What would sting & linger longer? Finding $20 in the parking lot? Or finding a $20 parking fine on your windshield?

We’ve been finding a lot of metaphorical “$20’s” (i.e. “positive results”) in our portfolios this year. So the second we find a parking fine (or a few in a row) we’ll be sure to ask if stocks are still the right place to park our money.

Complacency can work against us, Dear Clients. Just keep recalling your long-haul strategy and your “why” of investing.

***

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN. Mullin Wealth Management is located in Waite Park, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.