One more speed bump before year-end?

“Optimism sounds like a sales pitch.

Pessimism sounds like someone trying to help you.” Morgan Housel, The Psychology of Money

I do believe parts of the stock market are due for a reality check. But our big-picture, combined with our investment process says to hang in there. Connect with us now, especially if anything has changed for you.

Remember April and Tariff Tantrums? Portfolio risk still matters

Does is feel like stocks have done better than they actually have this year? Last year was a bumper year. And this year many have likely already forgotten the sharp April tariff tantrums.

In recent history, market reality checks have been brief. For example, COVID caused stock markets to drop aggressively, followed by a wild recovery. Then 2022 reminded investors that taking imprudent risk can burn you.

This rapid cycle of loss and recoveries makes it easier to get complacent. Yet, historical patterns suggest this isn't the time to ignore risk. It's easy to take on more risk after enjoying strong returns. But this can be dangerous—history doesn’t repeat, but it often rhymes.

Let’s talk portfolio risk; risk can = rewards; but at what price?

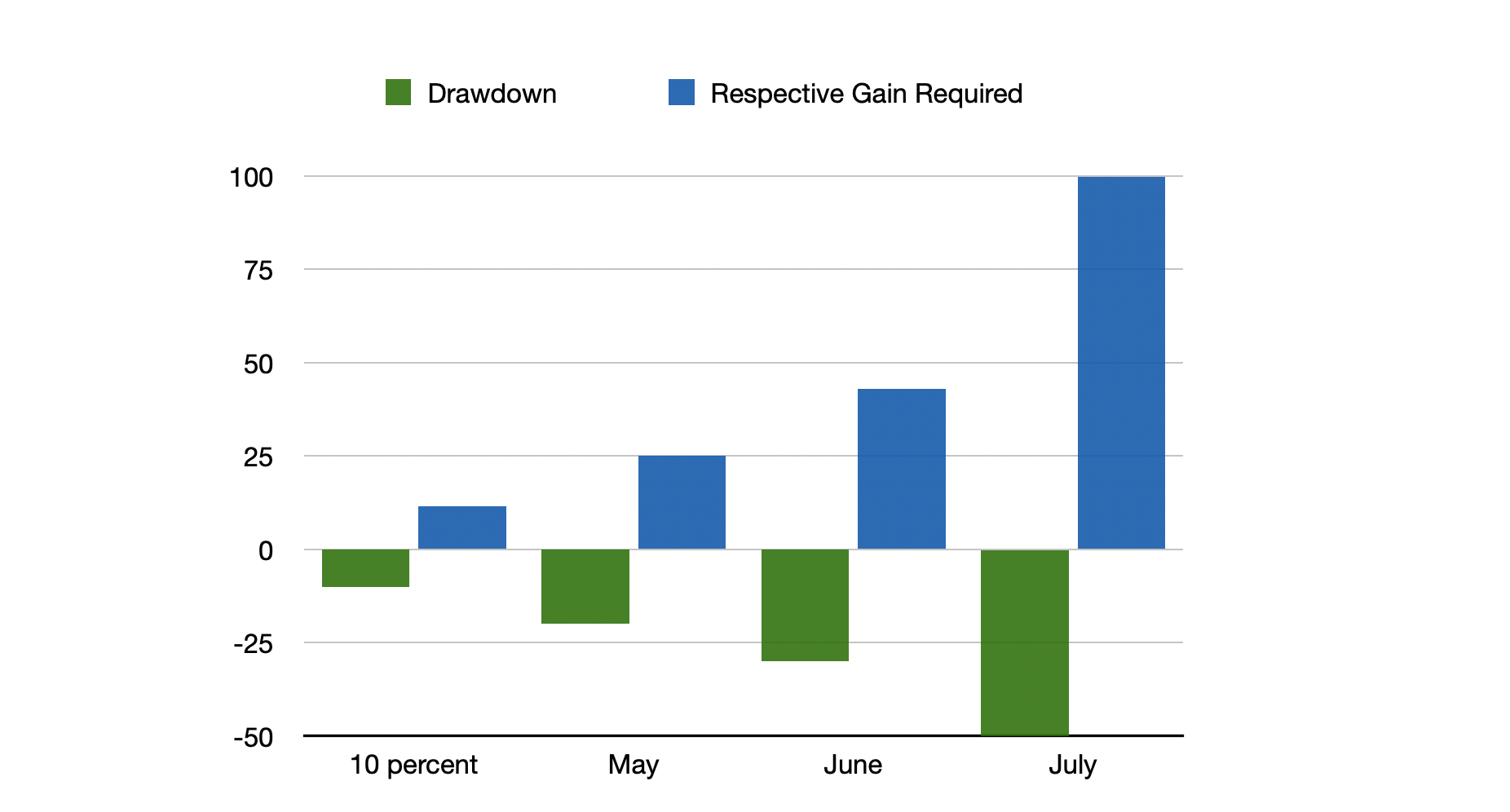

Let’s take a humble breath. Recall the math and logic of portfolio losses.

Bigger portfolio risks require a higher pain tolerance. Large portfolio losses are hard to recover from. If a $100,000 portfolio loses 20%, it drops to $80,000. To get back to even requires a 25% return on your $80,000.

It’s easy to take on more and more risk when we are being rewarded. But many experienced retirees know, “easy come, easy go.”

Is This Time Different? History Says, ‘Not So Fast.’

History has a way of reminding us not to get too comfortable when the markets are in a seemingly endless bull run. Take a look back:

March 2000: “Dow Pushes Over 11,000” — at the peak of the dot-com bubble, the market looked unstoppable. But the years following were a rough ride, with negative returns in 2000, 2001, and 2002. (wired.com)

October 2025: “The Stock Market Sounds an Alarm Seen Just 1 Time Before” — As the market appears strong, it's crucial to ask: Is it time for another correction? Time will tell. (Yahoo Finance)

November 2025: “The Week the AI Boom Got a Reality Check on Wall Street” — Even tech stocks, which had soared, faced a sharp reality check. Markets can change quickly, and we must remain vigilant. (WSJ)

Let’s Stay Grounded and Prepared

As we head toward the end of the year, it’s essential to stay aware of potential risks. Let’s revisit your portfolio, review your risk preferences, and make sure your strategy aligns with your long-term goals.

_____________________________

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Any economic forecasts set forth may not develop as predicted and are subject to change.

Investing involves risk including loss of principal.

References to markets, asset classes, and sectors are generally regarding the corresponding market index.

Indexes are unmanaged statistical composites and cannot be invested into directly.

Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges.

All performance referenced is historical and is no guarantee of future results.

No strategy assures success or protects against loss.

All indices are unmanaged and may not be invested into directly.

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

- Mullin's take on the "4% Retirement Rule"

- Navigate "Bad Portfolio Weather"

- Tips to Optimize Social Security

Articles and Assets

What are your Priorities?

Well it’s the end of the year. I just searched on Google for “market outlook 2018.” I came up with a little over 58-million “results.”

So should you be investing in stocks in 2018? The quick answer: It’s likely a prudent part of your portfolio. But it depends on your circumstances, right?

It’s apparently popular to throw your hat in the ring.

A mantra that you hear among disciplined professionals is to “stay the course.”

Then you hear “sell high, buy low.”

Who’s right?

The relief of a disciplined strategy is that it can be tailored to you. And tailor we think you should.

Yes, it’s possible that an investor may not utilize stocks in their portfolio at all. Or you may decide to go “all in” with a diversified stock portfolio.

(Side effects from tailoring a strategy may include increased confidence & persistence, apathy toward daily market reports, and increased focus on what really matters.)

Let’s begin with the “Why” of investing for you. Then you can request 15-minutes on the phone discuss your “how.”

So “Why Should You Invest”

Life changes and our “why” of investing ought to transform with life. Some invest for sport – they like the risk/reward of investing – they’re in it for the thrill. I don’t hang with this crowd.

Most of us ought to invest for things we want. Our money & our goals are serious. By investing in a diversified portfolio we can pursue things we want.

1. Living A Comfortable Retirement: Retirement is a noun. It’s up to you to really design and live a retirement that reflects you.

2. Purchasing a Home: Home is a place to live. It can take a down payment.

3. Passing an Inheritance on to Family:

4. Student Loan Shield: This idea is important for many Millennial graduates. Student loans can dominate your budget. But instead of accelerating those payments, what if you paid your required payments, and then invested the additional money that you were going to pay against your loan balance?

5. Emergency Reserves: You probably have read that it’s prudent to keep a relative healthy amount of cash in your checking/savings. Once you’ve achieved that, then you can consider investing additional funds. Go a step further and consider a non-retirement account for you and your house. You can spend this on cars, vacations or use it just as described in #4.

The Dow Jones has seen positive results, so far, in 2017. It’s unusual and sort of uncomfortable as the independent financial advisor. Why is it uncomfortable?

What would sting & linger longer? Finding $20 in the parking lot? Or finding a $20 parking fine on your windshield?

We’ve been finding a lot of metaphorical “$20’s” (i.e. “positive results”) in our portfolios this year. So the second we find a parking fine (or a few in a row) we’ll be sure to ask if stocks are still the right place to park our money.

Complacency can work against us, Dear Clients. Just keep recalling your long-haul strategy and your “why” of investing.

***

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN. Mullin Wealth Management is located in Waite Park, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.