Independent Power Producers in an Electricity Bull Market

Thomas Shipp | Head of Equity Research

Last Updated: June 05, 2025

Rising Utility: Independent Power Producers in an Electricity Bull Market

The energy landscape, and particularly the market for electricity, is evolving rapidly. Electricity demand and energy infrastructure spending are expected to continue growing over the coming years. Several catalysts have been cited for this growth — grid modernization to support renewable energy, electric vehicle (EV) adoption, and increased electrification broadly. However, the market didn’t credit utility stocks for these supposed growth drivers and only became interested when artificial intelligence (AI) was part of the story. In today’s blog, we discuss how AI-driven power demand, and the associated hyperscaler capital expenditures cycle, ultimately brought investor focus to the utility stocks purported to benefit most: Independent Power Producers (IPPs). These companies, including Constellation Energy (CEG), Vistra Corp (VST), and NRG Energy (NRG), own and operate power generation facilities. Unlike traditional utilities, IPPs operate in competitive markets, selling electricity directly to retail and wholesale customers.

The Data Center Connection

Much investor excitement around IPPs comes from the growth of power-hungry data centers, driven by continued investment in AI from cash-rich cloud computing hyperscalers, such as Amazon Web Services (AMZN), Microsoft Azure (MSFT), and Google Cloud Platform (GOOG/L). Technology companies beyond the cloud hyperscalers, such as OpenAI (privately held) and Meta Platforms (META), are also driving data center demand, and the requisite electricity, as they seek to build their own tech infrastructure, further reversing the trend of “asset-light” capital allocation policies seen in mega cap tech over the last decade. META announced a long-term power deal with CEG just this week.

Data centers require substantial amounts of reliable “always-on” power, and thus, suppliers of said power provide a highly valuable raw input for the latest AI model or application. Let’s explore longer term U.S. power demand forecasts to provide a contextual backdrop before analyzing the potential advantages held by IPPs.

Growing Demand for Power Supports IPPs’ Strengths

Demand for electricity is on the rise, and the trend is expected to continue for the foreseeable future. According to the U.S. Energy Information Administration (EIA), U.S. electricity consumption is forecasted to increase in 2025 and 2026, surpassing the all-time high reached in 2024. This growth is largely driven by the commercial and industrial (C&I) sectors, including data centers and manufacturing establishments. Additionally, a report by industry consultant ICF International (ICFI) suggests that U.S. electricity demand is expected to grow by 25% by 2030 and 78% by 2050.

Market consensus believes IPPs are among the best positioned to capitalize on this growing electricity demand. The smattering of long-term power supply contracts between technology companies and IPPs, as well as the increased investment from the IPPs themselves, supports this thesis. This can be attributed to several factors:

- Increased Capacity. IPPs are investing heavily in expanding their generation capacity by reviving/extending existing nuclear power plants and purchasing natural gas power plants (see below on IPP Growth Strategies).

- Market Dynamics. The competitive nature of the IPP market drives efficiency. Companies that can produce electricity at lower costs and with higher reliability are rewarded with better market positions and potentially lucrative long-term contracts.

- Policy Support. U.S. industrial policies are providing incentives to promote energy infrastructure investment, such as nuclear production tax credits.

- Investor Confidence. The combination of growing demand, innovative and flexible capacity expansion, and supportive federal policies and regulations has led to increased investor confidence. As a result, the stocks of IPPs have seen impressive returns, which in turn have allowed IPPs to leverage elevated equity values for growth investments.

IPP Growth Strategies in Power Generation Portfolio

Large public IPPs have pursued mergers and acquisitions (M&A) this year to enhance their power generation portfolios and capitalize on market opportunities. Below, we outline three deals from this year to demonstrate how the IPP flexible business model (and elevated equity valuations) supports capturing increased electricity demand.

Constellation Energy Group (CEG). In January, CEG agreed to acquire privately-held Calpine for $29.1 billion (inclusive of assuming $12.7 billion in Calpine’s debt), valuing the equity at $16.4 billion. CEG is funding the deal with ~$11.9 billion in stock (issuing 50 million shares, or ~13.1% of post-issuance total shares outstanding) and $4.5 billion in cash. After netting out cash generation at Calpine during 2025 (deal expected to close at end of 2025), the total enterprise value consideration is expected to be $26.6 billion, which the companies estimate is 7.9x 2026 estimated EBITDA.

The Calpine deal will make CEG the largest power producer in the U.S., adding 26gigawatts (GW) of gas-fired turbine power generation and 1.5GW of geothermal/renewables to its existing 33GW power generation (two-thirds of which is nuclear — CEG possesses the largest nuclear generation fleet).

Vistra (VST). In May, VST announced they would acquire natural gas assets from Lotus Infrastructure Partners for $1.9 billion, which represents a 7x 2026 adjusted EBITDA multiple. The deal is expected to close in late 2025 or early 2026. This natural gas deal quickly added 2.6GW of capacity, representing a 6.5% boost to VST’s capabilities. This capacity was added at a cost of ~$743/kilowatt (kW) which is two-thirds cheaper than the estimated $2,000/kW price of building, with the added benefit of faster integration.

NRG Energy (NRG). In May, NRG agreed to acquire 13 GW of gas generation from LS Power for a total enterprise value of ~$12 billion at a 7.5x 2026 enterprise value (EV)/EBITDA multiple. The equity value of ~$9 billion is being funded using two-thirds cash on hand and one-third stock. The deal is expected to close in early 2026, and the company noted that the acquisition would double NRG’s generation capacity.

Each of these deals followed similar growth strategies focused on natural gas generation. These deals, done at approximately 7–8x EBITDA, are currently cheaper and faster than building new facilities.; GE Vernova (GEV), a leading manufacturer of gas-fired turbines, recently said that orders placed today will not be delivered until 2028.

Valuation Insights

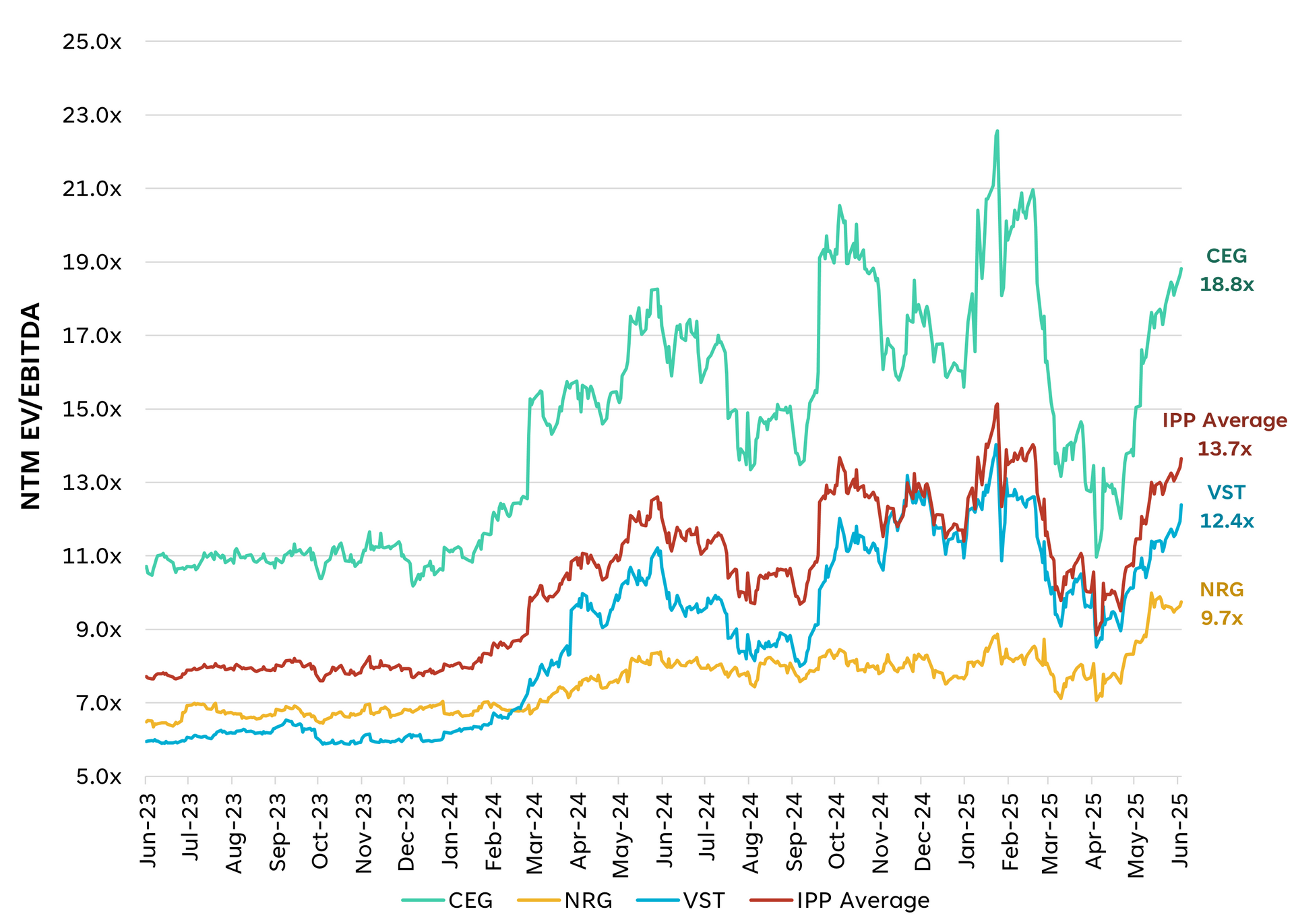

Since it was spun off from Exelon Corp (EXC) in January 2022, CEG has traded at an average 35%valuation premium to the peer group average. This premium can be attributed to its better credit profile, larger size, geographic mix, and carbon-free portfolio. VST has historically traded around the peer group average, and NRG has traded at a discount. NRG’s discount to peers could be attributed to its smaller size and less direct “pure-play data center/AI” thematic, which has only recently started to be discounted by the market, as the deal with LS Power not only expands NRG’s total generation capacity, but also significantly diversifies its geographic footprint.

IPP Valuations: Market Multiples Show CEG’s Premium, NRG’s Re-Rating

Source: LPL Research, Bloomberg 06/03/25

Disclosures: Past performance is no guarantee of future results.

IPP Average: Simple average of the three IPP valuation multiples in the exhibit (CEG, VST, NRG)

NTM EV/EBITDA: Similar to a price to earnings multiple, this valuation metric expresses the enterprise value (equity market value plus debt, less cash; reflective of the value of the entire enterprise) relative to consensus estimates of EBITDA (earnings before interest, taxes, depreciation, and amortization, a common measure of operating earnings) for the upcoming 12 months.

Conclusion

The expected growth in electricity demand in the U.S. is attributable to several factors, but the factor that has captured investor attention is the boom in data center construction in support of AI applications. IPPs have been beneficiaries of this theme, demonstrated by positive earnings revisions and long-term power contracts, as they have the business model and balance sheet to expand power generation to meet demand. Their flexibility has helped IPPs secure long-term contracts to supply power to individual technology companies and their data centers. However, with increased growth expectations and valuations comes increased risk, primarily of expectations not coming to fruition, such as long-term contracts getting priced into valuations only to not materialize for one reason or another (increased efficiency of new models, to cite a recent example). For now, with M&A and long-term contracts dominating the news flow in the industry, that risk has been accepted, or ignored.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #750265

- Mullin's take on the "4% Retirement Rule"

- Navigate "Bad Portfolio Weather"

- Tips to Optimize Social Security

Articles and Assets

What are your Priorities?

Well it’s the end of the year. I just searched on Google for “market outlook 2018.” I came up with a little over 58-million “results.”

So should you be investing in stocks in 2018? The quick answer: It’s likely a prudent part of your portfolio. But it depends on your circumstances, right?

It’s apparently popular to throw your hat in the ring.

A mantra that you hear among disciplined professionals is to “stay the course.”

Then you hear “sell high, buy low.”

Who’s right?

The relief of a disciplined strategy is that it can be tailored to you. And tailor we think you should.

Yes, it’s possible that an investor may not utilize stocks in their portfolio at all. Or you may decide to go “all in” with a diversified stock portfolio.

(Side effects from tailoring a strategy may include increased confidence & persistence, apathy toward daily market reports, and increased focus on what really matters.)

Let’s begin with the “Why” of investing for you. Then you can request 15-minutes on the phone discuss your “how.”

So “Why Should You Invest”

Life changes and our “why” of investing ought to transform with life. Some invest for sport – they like the risk/reward of investing – they’re in it for the thrill. I don’t hang with this crowd.

Most of us ought to invest for things we want. Our money & our goals are serious. By investing in a diversified portfolio we can pursue things we want.

1. Living A Comfortable Retirement: Retirement is a noun. It’s up to you to really design and live a retirement that reflects you.

2. Purchasing a Home: Home is a place to live. It can take a down payment.

3. Passing an Inheritance on to Family:

4. Student Loan Shield: This idea is important for many Millennial graduates. Student loans can dominate your budget. But instead of accelerating those payments, what if you paid your required payments, and then invested the additional money that you were going to pay against your loan balance?

5. Emergency Reserves: You probably have read that it’s prudent to keep a relative healthy amount of cash in your checking/savings. Once you’ve achieved that, then you can consider investing additional funds. Go a step further and consider a non-retirement account for you and your house. You can spend this on cars, vacations or use it just as described in #4.

The Dow Jones has seen positive results, so far, in 2017. It’s unusual and sort of uncomfortable as the independent financial advisor. Why is it uncomfortable?

What would sting & linger longer? Finding $20 in the parking lot? Or finding a $20 parking fine on your windshield?

We’ve been finding a lot of metaphorical “$20’s” (i.e. “positive results”) in our portfolios this year. So the second we find a parking fine (or a few in a row) we’ll be sure to ask if stocks are still the right place to park our money.

Complacency can work against us, Dear Clients. Just keep recalling your long-haul strategy and your “why” of investing.

***

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN. Mullin Wealth Management is located in Waite Park, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.