Good news three ways - let’s go fish!

My family just returned from a week of fishing and lake life along idyllic northern pine shores. The treasured mornings and nights came with a view of a picturesque reflection of the trees on the calm and clear lake.

We have taken a trip like this the past few summers. And this year the fish were biting! We had sunnies, perch, and bass a plenty. I grew up with trips to Crow Wing Lake #2 at my grandparents cabin near Park Rapids. But we never caught much for fish.

To catch fish you need to know a bit about them. Take the myth that fish are inactive during the afternoon, for example. Fish tend to go deep and hide in the hot summer afternoons. So a good angler should go fish deeper in the hot afternoon. But some avoid fishing midafternoon. Or maybe they give up too easily when the fish “aren’t biting.”

So that is my personal summer update, which serves as a good foundation for reminding folks like us to keep at this investing business.

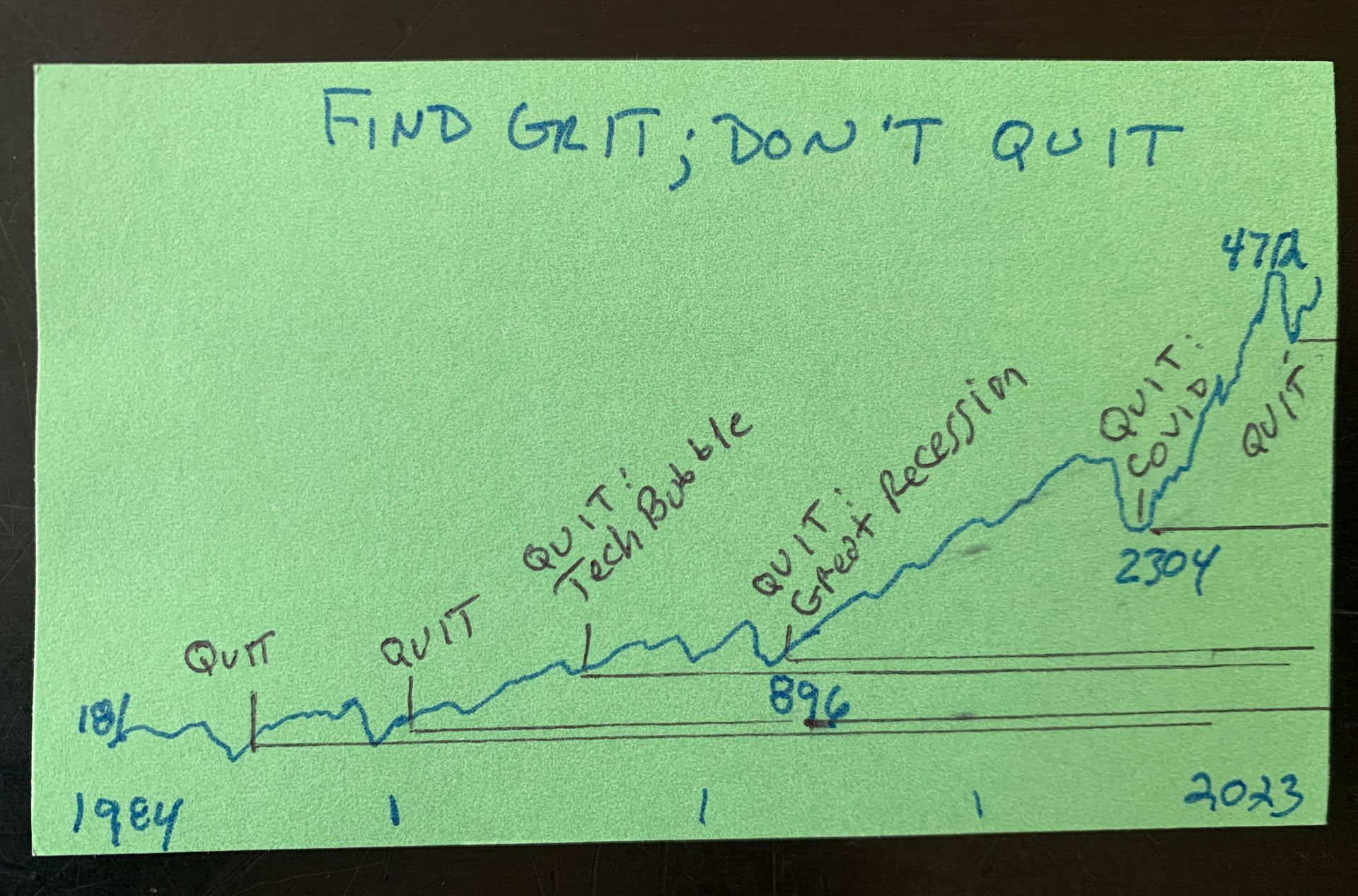

Not in decades has our style of investing ever been "broken." What happens is people decide the ideas are not working and quit. Be humble. Do not quit.

The investing market feels very much opportunistic at this time. You have to know where to look, and what to fish for.

Here are the three things that I am seeking to take advantage of or looking for next:

#1. Well run companies are looking good. Stocks are just too broad a topic. It is like telling someone you are going fishing. What kind? Shore fishing? Deep lake fishing? What type of fish ... you get it.

I have a high conviction for profitable companies that payout a profit to shareholders. (Watch this presentation.) I wrote in May that industrials would serve as a longer term investment pursuit because of the 100s of billions being made available from the government to rebuild water, roads, and infrastructure. Market Quiz: Guess what outperformed Microsoft’s stock in June? John Deere did; and Caterpillar. Oh, Deere! (Not an individual stock or investment recommendation.)

Give things time and good things can happen.

#2. Bonds took a bath; but are lurking for us.

At this time I would not pull up the anchor and leave bonds behind. And bonds are certainly still an anchor for my retirees portfolios and balanced portfolios. In fact, bonds overall are quiet and positive this year. (As measured by the Aggregate US Bond Index.)

-And while bond prices are down from last years bath, the equivalent yields (the interest they pay out) are substantially higher.

-Bond prices can rise when interest rates are reduced even a little from here. Informed investors know this is when bonds start to really grab hold. Bonds are definitely feeling like a big bite nibbling our line. Bonds values the past three years as an average have become like a beach ball being held under the waters surface. What happens when we let go of that beach ball? It pops up above the surface. Rates get cut a bit and bond investors who have been soaked should see value rise, again.

#3. We have higher interest rates for short term spending needs. Be forewarned that this does not last forever. Please get a good bank that pays a competitive interest rate (4+ % on savings are out there!).

-Do not over commit. Be ready and open to the idea that bonds and stocks have historically outperformed just as interest rates peak. And I do think interest rates have peaked right about here.

Is a recession next?

It might be. But that was the fear from 2010-2020. Today I can feel good about guiding folks through a scary prolonged bear market. Last May I said it felt like we were muddling through a self-induced recession. Perhaps that is what it amounted to. I also reminded folks that a recession arrives AFTER the market bottoms. Investors tend to sniff out the bad news in advance. Have we done that yet?

October 2022 was probably the low for equity investors. Can you be brave enough to go through this next period? Can you find optimism? Can you avoid the temptation to be greedy and act with FOMO? (A well known investor virus that causes an investor to act with a the fear of missing out.)

Phone it in if you have concerns or changes to review. We love hearing from you over the summer months.

Carry on.

Peter

Encore from May 2023

Fear Knocked; Facts Answered

That uncomfortable passenger's fear is real. Their fight-or-flight response is in high gear. But what are they worried about? They are worried about the unknown, of course! The fear and panic are real.

I would prefer that clients feel comfortable and fit for the miles in front of us. Let's look at investing for the long term while seizing upon facts.

Investing for the long term assumes that you buy and hold quality investments. But what about reading about the state of the markets we are investing in? Investing for the long term involves adapting as time passes. Observe facts and act accordingly.

Fact: The Inflation Reduction Act will infuse 100s of billions into the US Industrial and Energy space. (McKinsey) There is more being poured in over the next decade.

Fact: The CHIPS Act is bringing 10s of billions into US Semiconductor companies. (CNBC)

Fact: Higher yields are available to us now. Today, when money is moved from investments and put in "short-term" parking via money market funds or short-term treasuries, it reaps a good risk-off reward. This is a tricky dilemma. If money sits there too long you could miss out on growth via stocks. So the emphasis is on short-termhere. It is generally prudent to invest funds intended for growth into stocks.

Fact: Bond prices should go up when rates go down.

Probable Fact: Bond values that burst last year may boom soon. All it may take is a slight interest rate CUT from the Federal Reserve. So think about getting on (or remaining on) that plane before it takes off again.

*These are hypothetical examples are are not representative of any specific situation. Your results will vary.The hypothetical rate of return used does not reflect the deduction of fees and charges inherent to investing

Peter Mullin is an independent financial advisor registered through LPL Financial. He was born and raised in St. Cloud, MN. Mullin Wealth Management is headquartered in Saint Cloud, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation do not protect against market risk.

References to markets, asset classes, and sectors are generally regarding the corresponding market index.

Indexes are unmanaged statistical composites and cannot be invested into directly.

Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All performance referenced is historical and is no guarantee of future results.

The payment of dividends is not guaranteed. Companies may reduce or eliminate the payment of dividends at any given time.

No strategy assures success or protects against loss.

Securities and Advisory services offered through LPL Financial, A Registered Investment Advisor, Member FINRA/SIPC.

- Mullin's take on the "4% Retirement Rule"

- Navigate "Bad Portfolio Weather"

- Tips to Optimize Social Security

Articles and Assets

What are your Priorities?

Well it’s the end of the year. I just searched on Google for “market outlook 2018.” I came up with a little over 58-million “results.”

So should you be investing in stocks in 2018? The quick answer: It’s likely a prudent part of your portfolio. But it depends on your circumstances, right?

It’s apparently popular to throw your hat in the ring.

A mantra that you hear among disciplined professionals is to “stay the course.”

Then you hear “sell high, buy low.”

Who’s right?

The relief of a disciplined strategy is that it can be tailored to you. And tailor we think you should.

Yes, it’s possible that an investor may not utilize stocks in their portfolio at all. Or you may decide to go “all in” with a diversified stock portfolio.

(Side effects from tailoring a strategy may include increased confidence & persistence, apathy toward daily market reports, and increased focus on what really matters.)

Let’s begin with the “Why” of investing for you. Then you can request 15-minutes on the phone discuss your “how.”

So “Why Should You Invest”

Life changes and our “why” of investing ought to transform with life. Some invest for sport – they like the risk/reward of investing – they’re in it for the thrill. I don’t hang with this crowd.

Most of us ought to invest for things we want. Our money & our goals are serious. By investing in a diversified portfolio we can pursue things we want.

1. Living A Comfortable Retirement: Retirement is a noun. It’s up to you to really design and live a retirement that reflects you.

2. Purchasing a Home: Home is a place to live. It can take a down payment.

3. Passing an Inheritance on to Family:

4. Student Loan Shield: This idea is important for many Millennial graduates. Student loans can dominate your budget. But instead of accelerating those payments, what if you paid your required payments, and then invested the additional money that you were going to pay against your loan balance?

5. Emergency Reserves: You probably have read that it’s prudent to keep a relative healthy amount of cash in your checking/savings. Once you’ve achieved that, then you can consider investing additional funds. Go a step further and consider a non-retirement account for you and your house. You can spend this on cars, vacations or use it just as described in #4.

The Dow Jones has seen positive results, so far, in 2017. It’s unusual and sort of uncomfortable as the independent financial advisor. Why is it uncomfortable?

What would sting & linger longer? Finding $20 in the parking lot? Or finding a $20 parking fine on your windshield?

We’ve been finding a lot of metaphorical “$20’s” (i.e. “positive results”) in our portfolios this year. So the second we find a parking fine (or a few in a row) we’ll be sure to ask if stocks are still the right place to park our money.

Complacency can work against us, Dear Clients. Just keep recalling your long-haul strategy and your “why” of investing.

***

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN. Mullin Wealth Management is located in Waite Park, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.