Are Markets Ready to Take Off ? S14E9 May 2023

It is May, and we are nearing the year's halfway point. Here are two financial planning tips to look into this spring to save some money. Then, read on to learn about the investing environment.

This month I want to share two ideas that can add value unrelated to investing. They both take some time but can add some savings to your pocket.

- Consider a big one this time. Look at the real interest rate you are getting for the balance you keep at the bank.

1. $10,000 with a .5% rate gets $50 annually

2. $10,000 with a 3.5% rate gets $350 annually.

3. It would be best if you had a sum of funds available for your 3-12 month needs at the bank. Banks do serve a significant role in our lives. But the big banks still need to offer more in the way of interest. Check out the local banks in your area.

2. Check in with your internet and cable company. Has it been a few years since you asked them for a new rate or deal? I just got my Saint Cloud office internet bill reduced by $50 per month. I could not believe it! (That is $600 per year.)

Stay informed

Most clients truly delegate the tough work and gritty details to me. And delegating this work is what we are here for. So, if you are among the clients who entrust the process and decisions to us, here is your abbreviated update: I think we will be OK.

Regardless, read on to stay informed. An informed investor is better equipped for the road ahead.

Portfolio Placement

Some resources that guide my choices are in the below links. LPL Financial Research: April 2023 Global Strategy

Seasonal Portfolio Adjustments: Sell in May; but Monitor

Imagine sitting on an airplane and hitting an uncomfortable patch of turbulence. The fellow beside you gets up and starts knocking on the cockpit door, pleading loudly for reassurance. "You're sure you know what you're doing up there!?"

This ought to stand out as awkward behavior. And could have them escorted off at the next stop.

But this behavior is no different than those who try to handle investment uncertainty with spontaneous and wild changes.

Fear Knocked; Facts Answered

That uncomfortable passenger's fear is real. Their fight-or-flight response is in high gear. But what are they worried about? They are worried about the unknown, of course! The fear and panic are real.

I would prefer that clients feel comfortable and fit for the miles in front of us. Let's look at investing for the long term while seizing upon facts.

Investing for the long term assumes that you buy and hold quality investments. But what about reading about the state of the markets we are investing in? Investing for the long term involves adapting as time passes. Observe facts and act accordingly.

Fact: The Inflation Reduction Act will infuse 100s of billions into the US Industrial and Energy space. (McKinsey) There is more being poured in over the next decade.

Fact: The CHIPS Act is bringing 10s of billions into US Semiconductor companies. (CNBC)

Fact: Higher yields are available to us now. Today, when money is moved from investments and put in "short-term" parking via money market funds or short-term treasuries, it reaps a good risk-off reward. This is a tricky dilemma. If money sits there too long you could miss out on growth via stocks. So the emphasis is on short-termhere. It is generally prudent to invest funds intended for growth into stocks.

Fact: Bond prices should go up when rates go down.

Probable Fact: Bond values that burst last year may boom soon. All it may take is a slight interest rate CUT from the Federal Reserve. So think about getting on (or remaining on) that plane before it takes off again.

Investment Take Aways

So what is our 6-month pathway through the current environment? Well, the good news is we are using ideas that have been through this before. Broadly, I have taken a more defensive posture. But there are better ways to achieve long-term portfolio growth than a defensive posture. So the next six months will see additions to my core and tactical ideas.

- Holding some investment funds in short-term cash or cash-like positions is savvy. Each unit of low risk is rewarded with a big reward in the form of interest or yield.

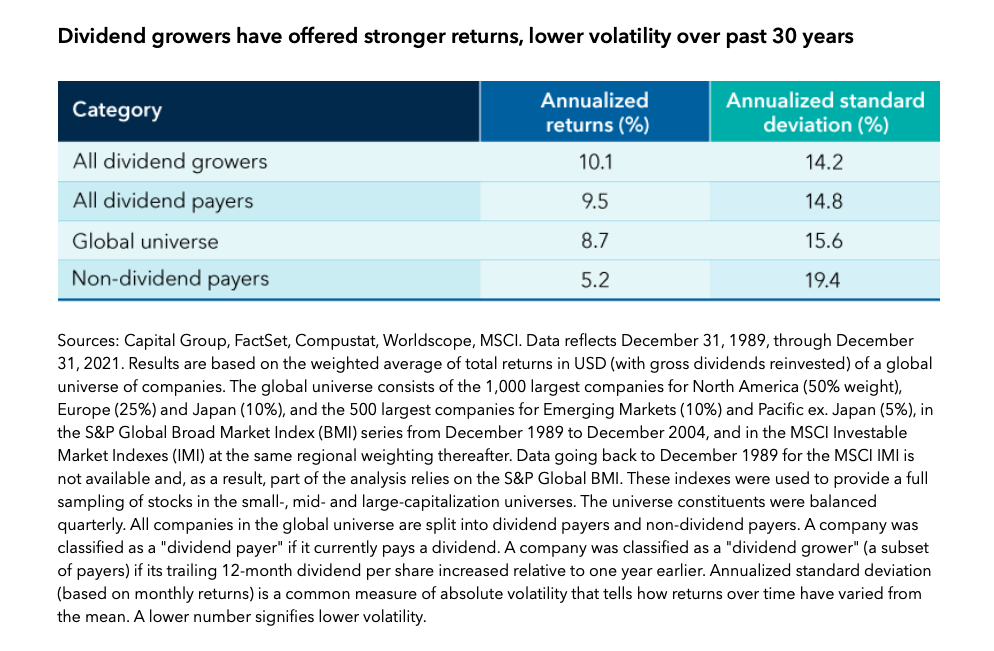

- Dividend-paying stocks are still in focus. Dividends are how companies pass success and profit on to shareholders. Watch my webinar. Click here. Dividend stocks may feel sluggish from time to time. But long-term investors have been rewarded.

- Industrials and green energy will be topical for some time. Billions will be poured into this space over the next decade.

The above image and chart regarding dividend growers is provided via Capital Group/American Funds.

*These are hypothetical examples are are not representative of any specific situation. Your results will vary.The hypothetical rate of return used does not reflect the deduction of fees and charges inherent to investing

Peter Mullin is an independent financial advisor registered through LPL Financial. He was born and raised in St. Cloud, MN. Mullin Wealth Management is headquartered in Saint Cloud, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation do not protect against market risk.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All performance referenced is historical and is no guarantee of future results.

The payment of dividends is not guaranteed. Companies may reduce or eliminate the payment of dividends at any given time.

No strategy assures success or protects against loss.

Securities and Advisory services offered through LPL Financial, A Registered Investment Advisor, Member FINRA/SIPC.

- Mullin's take on the "4% Retirement Rule"

- Navigate "Bad Portfolio Weather"

- Tips to Optimize Social Security

Articles and Assets

What are your Priorities?

Well it’s the end of the year. I just searched on Google for “market outlook 2018.” I came up with a little over 58-million “results.”

So should you be investing in stocks in 2018? The quick answer: It’s likely a prudent part of your portfolio. But it depends on your circumstances, right?

It’s apparently popular to throw your hat in the ring.

A mantra that you hear among disciplined professionals is to “stay the course.”

Then you hear “sell high, buy low.”

Who’s right?

The relief of a disciplined strategy is that it can be tailored to you. And tailor we think you should.

Yes, it’s possible that an investor may not utilize stocks in their portfolio at all. Or you may decide to go “all in” with a diversified stock portfolio.

(Side effects from tailoring a strategy may include increased confidence & persistence, apathy toward daily market reports, and increased focus on what really matters.)

Let’s begin with the “Why” of investing for you. Then you can request 15-minutes on the phone discuss your “how.”

So “Why Should You Invest”

Life changes and our “why” of investing ought to transform with life. Some invest for sport – they like the risk/reward of investing – they’re in it for the thrill. I don’t hang with this crowd.

Most of us ought to invest for things we want. Our money & our goals are serious. By investing in a diversified portfolio we can pursue things we want.

1. Living A Comfortable Retirement: Retirement is a noun. It’s up to you to really design and live a retirement that reflects you.

2. Purchasing a Home: Home is a place to live. It can take a down payment.

3. Passing an Inheritance on to Family:

4. Student Loan Shield: This idea is important for many Millennial graduates. Student loans can dominate your budget. But instead of accelerating those payments, what if you paid your required payments, and then invested the additional money that you were going to pay against your loan balance?

5. Emergency Reserves: You probably have read that it’s prudent to keep a relative healthy amount of cash in your checking/savings. Once you’ve achieved that, then you can consider investing additional funds. Go a step further and consider a non-retirement account for you and your house. You can spend this on cars, vacations or use it just as described in #4.

The Dow Jones has seen positive results, so far, in 2017. It’s unusual and sort of uncomfortable as the independent financial advisor. Why is it uncomfortable?

What would sting & linger longer? Finding $20 in the parking lot? Or finding a $20 parking fine on your windshield?

We’ve been finding a lot of metaphorical “$20’s” (i.e. “positive results”) in our portfolios this year. So the second we find a parking fine (or a few in a row) we’ll be sure to ask if stocks are still the right place to park our money.

Complacency can work against us, Dear Clients. Just keep recalling your long-haul strategy and your “why” of investing.

***

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN. Mullin Wealth Management is located in Waite Park, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.