2nd Quarter Portfolio Updates

Never forget that toilet paper was not an economic indicator

A 7-8 minute read; please do read and pass it along. I spent some time writing to catch you up on what may be a part of your portfolio.

In this quarterly portfolio update, Clients, I feel it is important to remember The Little Engine That Could. This quarterly update should be helpful as we are now entering the mountain phase of a bull market.

Indeed, Spring of 2020 saw the economic train run to the valley floors. Some feared that there would be no valley to catch us. And some still ran to buy … toilet paper?

Yet we quickly saw these massive companies – innovators and adaptors – rising out of that valley and bringing our portfolios along for the single swiftest recovery in US Market history.

This next part of the investor journey likely sees higher peaks and higher valleys.

But wealth climbs a mountain of worry. Today the vaccine deployment mission in the US feels like two trains running toward one another. We may see cases or variants increase. Who gets to the station first? Inoculation? And if we become an inoculated nation, then what about the rest of the world?

Now what? The 2021 stock investing environment

You can read a lot about what is on investors' and institutions' minds today. Spoiler alert: Investing involves risk. If you can't stand the heat, get out of the kitchen.

Today there is much chatter about potential risks. I suggest that they are the same as they have been for decades. Inflation? What about rising debt? We are hearing about supply chain issues and rising costs. Folks, this is the mountain of worry I preach about persistently.

In the short term, let's stoke our engine for the ride ahead.

2021: Maybe things are working for the economy and markets

I recently hosted a Live Facebook broadcast with Ryan Detrick, Chief Market Strategist for LPL Financial. He is the big picture guy and is on CNBC, YAHOO Finance, and Bloomberg routinely. Please, follow and like our Facebook page. You will catch a lot of real-time updates here >> www.facebook.com/mullinwealth

Below is a chart I reviewed with Detrick. It provides a picture of what might be ahead. And why March 2021 has proven to be stubborn. After the first year of the '82 and '09 bull markets, we saw a pause. It is very similar to what we see now. But if we fast forward to the summer and fall, we may see a different story.

Some have said that we can't look at past recoveries and past bull markets because this is different. Is it? The playbook that I used for broad portfolio guidance in 2020 called upon a similar strategy based upon what played out in 2008 and 2009 and prior crises. Economic cycles tend to be very similar. And so, the investment classes that fuel portfolios tend to be similar.

Toilet paper was not an economic indicator in 2020. But travel and dining can be indicators.

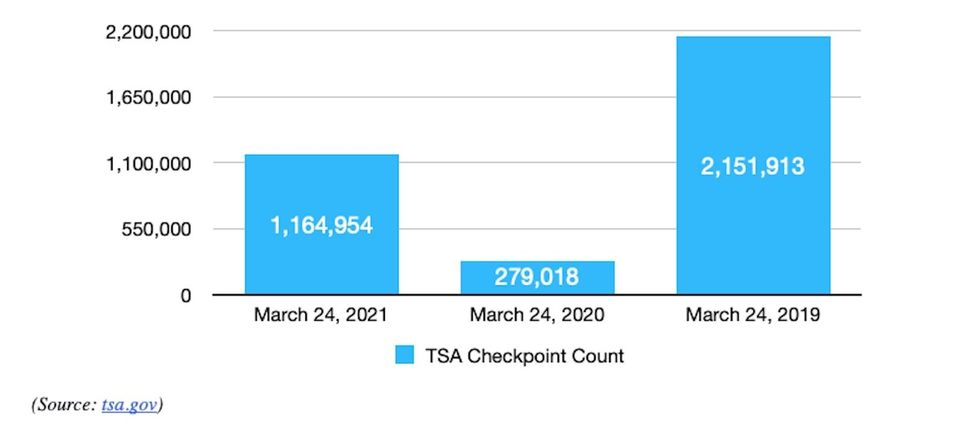

Have you been out to eat more recently? Have you now booked a flight? Things seem to be getting broadly better. Look at travel. The TSA provides passenger checkpoint numbers daily. Here we look at those numbers compared to past years:

(Source: tsa.gov)

Stay tuned for my upcoming blog posts that do go into more detail about 2021 topics and portfolio positions. Below are several ideas in bullet-point form that I like. Clients may note they have seen these ideas integrated into some portfolios with that in mind.

Is it time to discuss your portfolio positions? Or a change in your life?

We are here for you as life and portfolios change.

Until next time, carry on!

_____________________________

Zoom in on potential portfolio positions in 2021

I. I am liking a couple niche areas in health and technology.

Gene and bio health therapy

- These are companies with lots of risks but many potential rewards baked in. They have high levels of profit reinvested into their research.

If you read up on this space, I think you will see the God-given science there. The potential for cancer treatments, rare diseases, and healthcare improvement could transform lives.

Semiconductors - Semiconductors have a considerable backlog. But I tend to like that. We've been planting seeds in this area for when that backlog catches up. And these semiconductors touch a lot of the goods we use. Semiconductors are in cars. Remember how I just talked about the new car supply being down? Everybody was buying toilet paper a year ago. But we were also buying computers, web cameras, and TVs.

II. Possible updates

Renewable energy - I like the idea of renewable energy. I became skeptical of the overall price point. It may be something to monitor and add to in the future. But clients may have seen this position reduced or eliminated.

###

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN.

Investing involves risks including the possible loss of capital.

The payment of dividends is not guaranteed. Companies may reduce or elimiate the payment of dividends at any given time. Stock investing invloves risks, including the loss of principal.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investments may be appropriate for you, consult your financial advisor prior to investing.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

No strategy assures success or protects against loss.

Securities and Advisory services offered through LPL Financial, A Registered Investment Advisor, Member FINRA/SIPC.

- Mullin's take on the "4% Retirement Rule"

- Navigate "Bad Portfolio Weather"

- Tips to Optimize Social Security

Articles and Assets

What are your Priorities?

Well it’s the end of the year. I just searched on Google for “market outlook 2018.” I came up with a little over 58-million “results.”

So should you be investing in stocks in 2018? The quick answer: It’s likely a prudent part of your portfolio. But it depends on your circumstances, right?

It’s apparently popular to throw your hat in the ring.

A mantra that you hear among disciplined professionals is to “stay the course.”

Then you hear “sell high, buy low.”

Who’s right?

The relief of a disciplined strategy is that it can be tailored to you. And tailor we think you should.

Yes, it’s possible that an investor may not utilize stocks in their portfolio at all. Or you may decide to go “all in” with a diversified stock portfolio.

(Side effects from tailoring a strategy may include increased confidence & persistence, apathy toward daily market reports, and increased focus on what really matters.)

Let’s begin with the “Why” of investing for you. Then you can request 15-minutes on the phone discuss your “how.”

So “Why Should You Invest”

Life changes and our “why” of investing ought to transform with life. Some invest for sport – they like the risk/reward of investing – they’re in it for the thrill. I don’t hang with this crowd.

Most of us ought to invest for things we want. Our money & our goals are serious. By investing in a diversified portfolio we can pursue things we want.

1. Living A Comfortable Retirement: Retirement is a noun. It’s up to you to really design and live a retirement that reflects you.

2. Purchasing a Home: Home is a place to live. It can take a down payment.

3. Passing an Inheritance on to Family:

4. Student Loan Shield: This idea is important for many Millennial graduates. Student loans can dominate your budget. But instead of accelerating those payments, what if you paid your required payments, and then invested the additional money that you were going to pay against your loan balance?

5. Emergency Reserves: You probably have read that it’s prudent to keep a relative healthy amount of cash in your checking/savings. Once you’ve achieved that, then you can consider investing additional funds. Go a step further and consider a non-retirement account for you and your house. You can spend this on cars, vacations or use it just as described in #4.

The Dow Jones has seen positive results, so far, in 2017. It’s unusual and sort of uncomfortable as the independent financial advisor. Why is it uncomfortable?

What would sting & linger longer? Finding $20 in the parking lot? Or finding a $20 parking fine on your windshield?

We’ve been finding a lot of metaphorical “$20’s” (i.e. “positive results”) in our portfolios this year. So the second we find a parking fine (or a few in a row) we’ll be sure to ask if stocks are still the right place to park our money.

Complacency can work against us, Dear Clients. Just keep recalling your long-haul strategy and your “why” of investing.

***

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN. Mullin Wealth Management is located in Waite Park, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.