Second Quarter From Peter’s Desk

Quarterly Kernels

We had two terrific years in portfolios. Again, many clients see those results on paper as taxes are filed for 2021. We moved on from some decent gains to remodel our portfolios for the upcoming season.

Today I am partly preparing for a climate where protecting a portfolio is equally as valuable as growing the portfolio. So I am closely monitoring inflation, recession concerns, and how consumers are feeling.

What’s next?

Now, multiple sources, including LPL Research, tell us to remain steadfast and realize that we can avoid a recession at least for 12-18 months.

But I am a fan of preparing firewood before the winter storm.

So that’s what we will do – just in case. There are

plenty of reasons to remain measuredly optimistic for US Stocks - especially particular categories of stocks.

Inflation is a mess. It is also difficult to forecast. This inflation

comes from excess money being poured on consumers

when we stopped the economy. It has been

intensified through supply-chain issues and war.

You don’t get out of an economic period in weeks. The economy

thinks in quarters and years.

What is the government thinking?

The Federal Reserve still has the ball to start the 2nd quarter of the year. And its effects will take months to be felt. But some things have begun to show slight moves toward normal.

Used car demand is down, according to CoPilot. But prices are still sky-high. As the demand for a used car slows, the price ought to correct.

Mortgage rates are already north of 5%, which I think is good thing for those who have been overwhelmed by the irrational housing market. Higher rates makes a monthly mortgage payment more expensive for a buyer with a mortgage. It makes a buyer redo the math.

-More homes were listed this spring. That means more inventory.

-More listings had to reduce their price in March 2022. (Redfin)

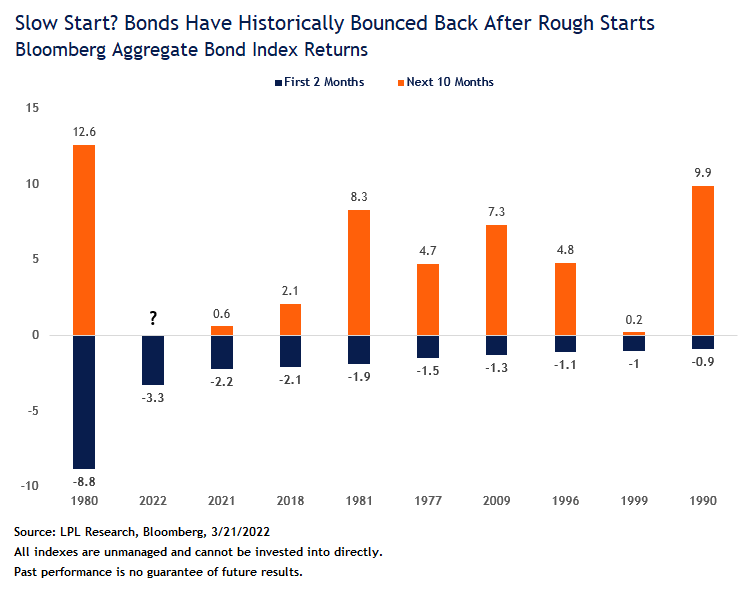

Bond investors have been surprised by interest rate hikes affect on the “safe money.” But reemember, bonds two key components act like a tipping teeter-totter. Rates go up. Bond principal goes down. As we anticipate interest rates rising toward 3% and 3.5%, this could present an attractive refueling opportunity for bond investors.

What is helping fuel custom portfolios?

Bonds: It has been years since I have seen potential beyond an interest rate in bonds. Thank you, Federal Reserve! Many clients have been underweighted bonds for a couple years or more. Though certain types of bonds - like corporate bonds - surprised investors to the downside in March 2022, the move provides a compelling spot to start adding back to bonds.

Particular categories of bonds - like municipal bonds - likely were unfairly punished and can spring back. This happened before in March 2020. It is like holding a beach ball underwater and then letting go.

I have been telling clients for years that decent bond rates are hard to come by. It is about time we get some interest on the money we loan via bonds!

Some defensive posturing and continued commitment to the long haul:

Client portfolios may have seen some additions, such as healthcare exposure. Healthcare management companies, in particular, can be more defensive. But we have to think more long term than the next year or so. For example, it is hard to imagine a world without technology and a need for energy.

Be prepared for the road ahead. Until next time, carry on!

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investments may be appropriate for you, consult your financial advisor prior to investing.

Investing involves risks including possible loss of principal.

Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

- Mullin's take on the "4% Retirement Rule"

- Navigate "Bad Portfolio Weather"

- Tips to Optimize Social Security

Articles and Assets

What are your Priorities?

Well it’s the end of the year. I just searched on Google for “market outlook 2018.” I came up with a little over 58-million “results.”

So should you be investing in stocks in 2018? The quick answer: It’s likely a prudent part of your portfolio. But it depends on your circumstances, right?

It’s apparently popular to throw your hat in the ring.

A mantra that you hear among disciplined professionals is to “stay the course.”

Then you hear “sell high, buy low.”

Who’s right?

The relief of a disciplined strategy is that it can be tailored to you. And tailor we think you should.

Yes, it’s possible that an investor may not utilize stocks in their portfolio at all. Or you may decide to go “all in” with a diversified stock portfolio.

(Side effects from tailoring a strategy may include increased confidence & persistence, apathy toward daily market reports, and increased focus on what really matters.)

Let’s begin with the “Why” of investing for you. Then you can request 15-minutes on the phone discuss your “how.”

So “Why Should You Invest”

Life changes and our “why” of investing ought to transform with life. Some invest for sport – they like the risk/reward of investing – they’re in it for the thrill. I don’t hang with this crowd.

Most of us ought to invest for things we want. Our money & our goals are serious. By investing in a diversified portfolio we can pursue things we want.

1. Living A Comfortable Retirement: Retirement is a noun. It’s up to you to really design and live a retirement that reflects you.

2. Purchasing a Home: Home is a place to live. It can take a down payment.

3. Passing an Inheritance on to Family:

4. Student Loan Shield: This idea is important for many Millennial graduates. Student loans can dominate your budget. But instead of accelerating those payments, what if you paid your required payments, and then invested the additional money that you were going to pay against your loan balance?

5. Emergency Reserves: You probably have read that it’s prudent to keep a relative healthy amount of cash in your checking/savings. Once you’ve achieved that, then you can consider investing additional funds. Go a step further and consider a non-retirement account for you and your house. You can spend this on cars, vacations or use it just as described in #4.

The Dow Jones has seen positive results, so far, in 2017. It’s unusual and sort of uncomfortable as the independent financial advisor. Why is it uncomfortable?

What would sting & linger longer? Finding $20 in the parking lot? Or finding a $20 parking fine on your windshield?

We’ve been finding a lot of metaphorical “$20’s” (i.e. “positive results”) in our portfolios this year. So the second we find a parking fine (or a few in a row) we’ll be sure to ask if stocks are still the right place to park our money.

Complacency can work against us, Dear Clients. Just keep recalling your long-haul strategy and your “why” of investing.

***

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN. Mullin Wealth Management is located in Waite Park, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.