2022 Outlook

Living and Investing in 2022 : The year for tantrums

Living and Investing in 2022 : The year for tantrums

- My outlook for 2022 is clear. I know with 100% certainty that client portfolios will fluctuate.

- I also believe that the Federal Reserve is king this year.

- The hunt for an “average” return may likely be more rewarding this year than the hunt for the “big wins.”

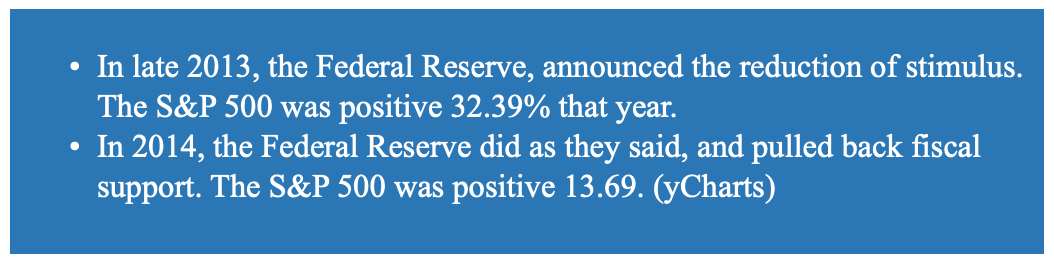

The Federal Reserve has a playbook from prior cycles of crisis. And this one is no different. Easy money, spending and borrowing must eventually be slowed. We can go back to nearly a decade ago and see what happened for stocks then.

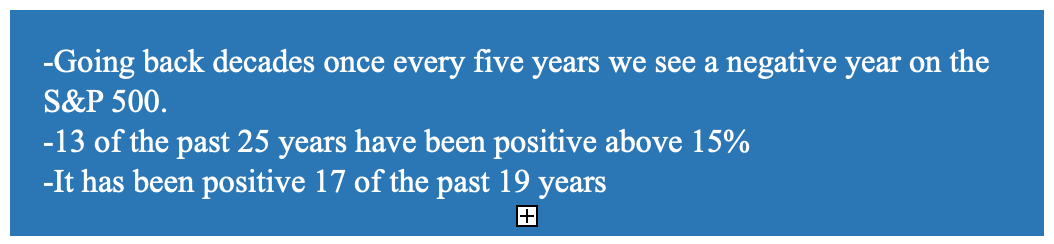

A critical lesson to recall this year is that the average involves the surprise downsides. Think about this: It is possible to see more negative daily returns than positive days; and yet, still have a positive return at the end of the year. Daily movements can be nauseating. But the view of the average feels better over stretches of time.

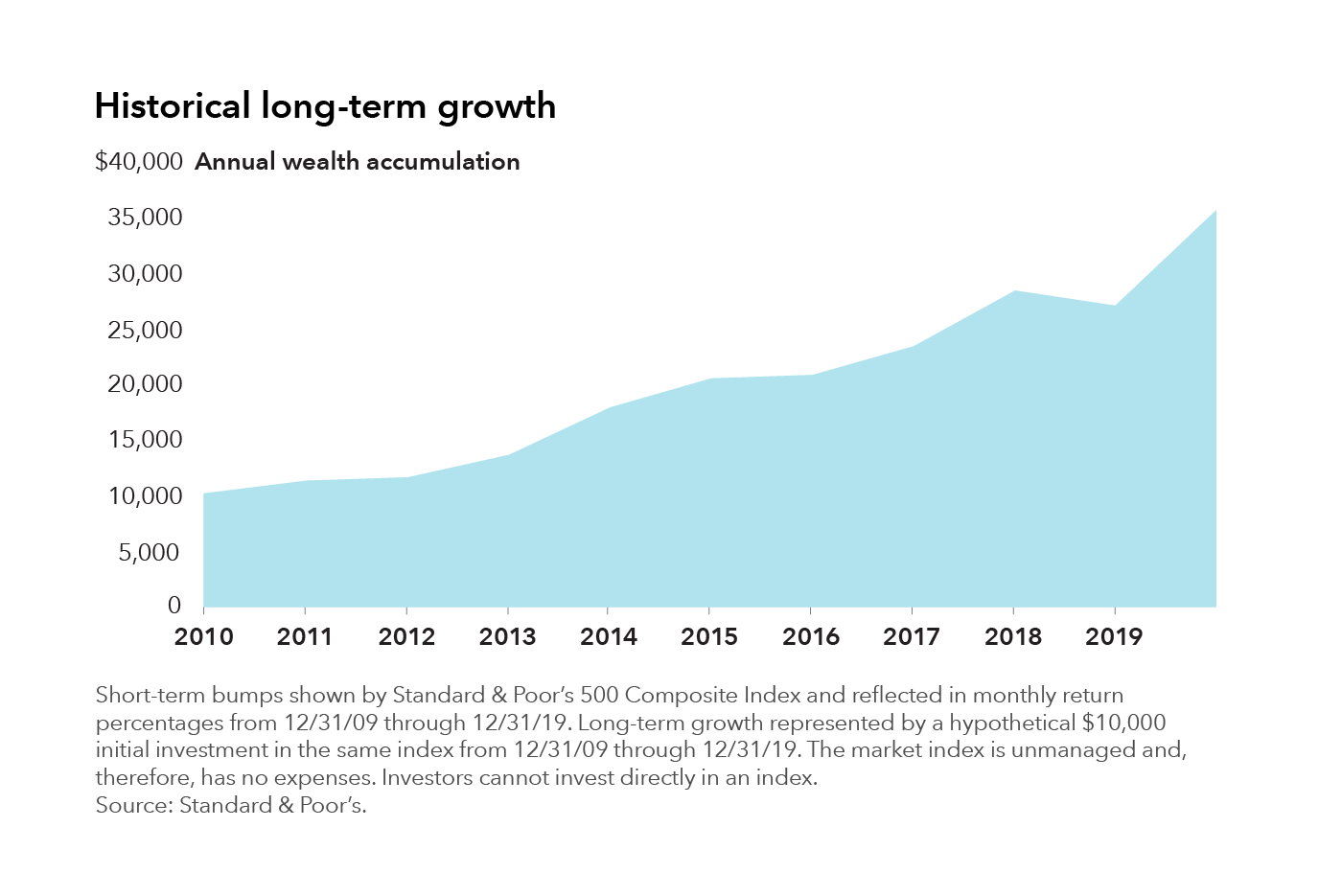

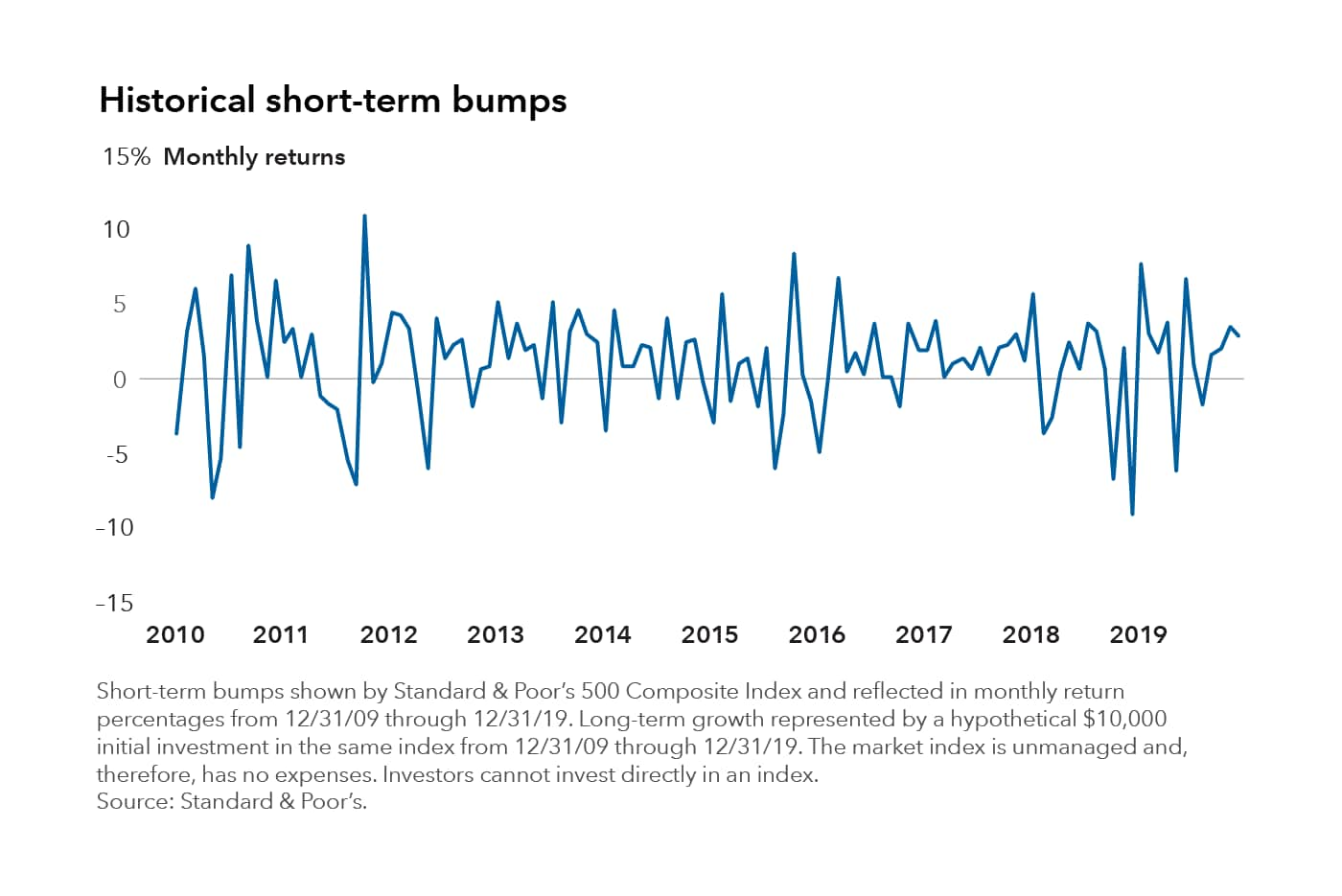

Here are two quick charts to highlight the point. They are both provided by American Funds team. It shows an investor starting with $10,000 in 2010. The returns do appear quite smooth. The second chart shows you that the monthly returns were not so easily captured. In fact, monthly returns can feel very lumpy.

Compared to the first chart, this monthly return sure shows off the swings of the S&P 500. No wonder the market gets clicks and views in the news cycle. It’s exciting and scary. This chart looks like a heartbeat EKG.

The Fed has stated that interest rate increases and lessened fiscal support are coming for some time now. So I expected to see tantrums in perhaps May and June. But now, we probably shift our expectation for some portfolio tantrums to this first quarter.

On January 5th, Morgan Stanley published a podcast I listened to about how it could be that 2022 was off to such a good start.

Then January 6th happened. The Federal Reserve released Minutes from December that said we should expect interest rate increases and reduced fiscal support earlier in the year. The good news? Inflation probably comes into check, especially as supply chains catch up, to boot.

On January 6th, investors responded like a toddler who is repeatedly told that the TV is going off after their show is over. Then the show ends, and you turn the TV off. What happens next? The toddler tantrum.

Investors that have been expecting this news for some time can feel okay. Now I choose to wait and add funds and buy the dips where we can. That is how we respond to tantrums. It could last a few weeks or a few months. Either way, I think we are well equipped and informed for this period.

Month to month, things may feel uncomfortable and uncertain. But when we take years in stride, things feel better.

Now some investor history to remind us WHY we put up with tantrums:

Need more insights? You can go online and review LPL Financial’s 2022 Outlook. You can also find it on my website under the blog.

So that is what 2022 may hold. Enjoy life in the meantime.

Carry on!

###

yCharts, https://ycharts.com/indicators/sp_500_total_return_annual

American Funds , Capital Ideas

Peter Mullin is an independent financial advisor registered through LPL Financial.

Investing involves risks including the possible loss of capital.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investments may be appropriate for you, consult your financial advisor prior to investing.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

No strategy assures success or protects against loss.

Securities and Advisory services offered through LPL Financial, A Registered Investment Advisor, Member FINRA/SIPC.

- Mullin's take on the "4% Retirement Rule"

- Navigate "Bad Portfolio Weather"

- Tips to Optimize Social Security

Articles and Assets

What are your Priorities?

Well it’s the end of the year. I just searched on Google for “market outlook 2018.” I came up with a little over 58-million “results.”

So should you be investing in stocks in 2018? The quick answer: It’s likely a prudent part of your portfolio. But it depends on your circumstances, right?

It’s apparently popular to throw your hat in the ring.

A mantra that you hear among disciplined professionals is to “stay the course.”

Then you hear “sell high, buy low.”

Who’s right?

The relief of a disciplined strategy is that it can be tailored to you. And tailor we think you should.

Yes, it’s possible that an investor may not utilize stocks in their portfolio at all. Or you may decide to go “all in” with a diversified stock portfolio.

(Side effects from tailoring a strategy may include increased confidence & persistence, apathy toward daily market reports, and increased focus on what really matters.)

Let’s begin with the “Why” of investing for you. Then you can request 15-minutes on the phone discuss your “how.”

So “Why Should You Invest”

Life changes and our “why” of investing ought to transform with life. Some invest for sport – they like the risk/reward of investing – they’re in it for the thrill. I don’t hang with this crowd.

Most of us ought to invest for things we want. Our money & our goals are serious. By investing in a diversified portfolio we can pursue things we want.

1. Living A Comfortable Retirement: Retirement is a noun. It’s up to you to really design and live a retirement that reflects you.

2. Purchasing a Home: Home is a place to live. It can take a down payment.

3. Passing an Inheritance on to Family:

4. Student Loan Shield: This idea is important for many Millennial graduates. Student loans can dominate your budget. But instead of accelerating those payments, what if you paid your required payments, and then invested the additional money that you were going to pay against your loan balance?

5. Emergency Reserves: You probably have read that it’s prudent to keep a relative healthy amount of cash in your checking/savings. Once you’ve achieved that, then you can consider investing additional funds. Go a step further and consider a non-retirement account for you and your house. You can spend this on cars, vacations or use it just as described in #4.

The Dow Jones has seen positive results, so far, in 2017. It’s unusual and sort of uncomfortable as the independent financial advisor. Why is it uncomfortable?

What would sting & linger longer? Finding $20 in the parking lot? Or finding a $20 parking fine on your windshield?

We’ve been finding a lot of metaphorical “$20’s” (i.e. “positive results”) in our portfolios this year. So the second we find a parking fine (or a few in a row) we’ll be sure to ask if stocks are still the right place to park our money.

Complacency can work against us, Dear Clients. Just keep recalling your long-haul strategy and your “why” of investing.

***

Peter Mullin is an independent financial advisor registered through LPL Financial. He lives in Rogers, MN with his family. He was born and raised in St. Cloud, MN. Mullin Wealth Management is located in Waite Park, MN.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. No strategy assures success or protects against loss.